[HKSE: 1211]

Type: Fast Grower

Business Description:

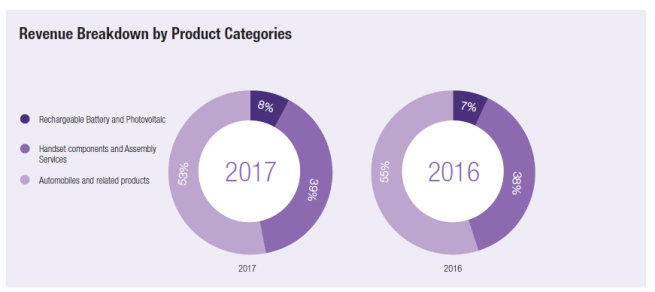

- Rechargeable battery manufacturer

- Suppliers for handset components and assembly services

- Automobile, new energy vehicles

Market Cap: $22 billion USD

Thesis:

- Growth from Energy Vehicles (EV) sales

- Growth from Sky-rails systems

BUSINESS

About BYD,

- One of the world’s leading suppliers for handset components and assembly services. Main customers of the business include Samsung, Huawei, Apple, Lenovo, Vivo, Xiaomi and other intelligent mobile terminal leaders, providing them with products of metal casings and metal middle frames etc.

- One of the leading rechargeable battery manufacturers in the global arena. Lithium-ion and nickel batteries produced by the Group are widely applied in handsets, digital cameras, power tools, electric toys and other portable electronic devices and electric products.

- Started automobile business in 2003, pioneering in the research and development and promotion of new energy vehicles in the world.

“Going forward, BYD will continue to regard new energy vehicles and ‘Skyrail’ as the key strategic development directions.” -Wang Chuanfu

Therefore, this research will focus mainly on new energy vehicles and its skyrail business.

New Energy Vehicles

Britain,

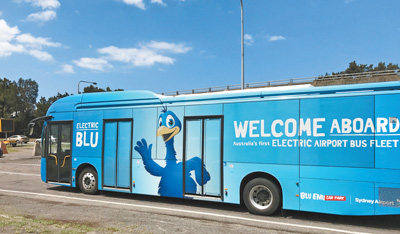

Australia,

Italy,

Korea,

America,

- BYD wins America’s largest electric bus order. (2015)

- San Francisco Goodwill Taps BYD To Supply 11 Zero-Emission Electric Trucks To Bay Area. (2017)

Singapore,

“Although its market is not as big as China’s, Singapore has a very strong demonstrative effect. It has great influence in West and South-east Asia.” -Wang Chuanfu

- “China’s subways have made inroads into African countries such as Egypt and Ethiopia, but if we manage to enter Singapore, a developed country with such high service standards, it will be greatly beneficial to the building of the BRI, as well as our car industry,”

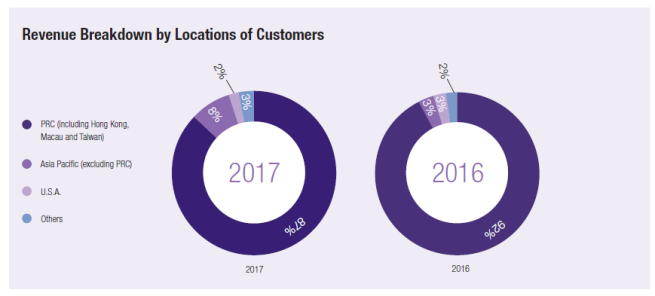

From all these information, we can observe that BYD has started to enter the global market aggressively since 2017. Instead of just focusing on premium electric cars like Tesla, BYD focuses more on public transport systems such as buses, taxis and skyrail.

Thoughts: Is there a possibility of SMRT & SBS (Singapore) collaborating with BYD?

Skyrail

- SkyRail as a strategic solution to urban traffic congestion problems.

- BYD claims SkyRail can be implemented at one-fifth the cost of a monorail system in one-third of the construction time.

- The first SkyRail implementation is in Yinchuan, China’s most important “smart city”

- SkyRail can run at speeds of 80 km/h (50 mph), it is so quiet in operation that it can be routed through buildings.

- BYD has conducted feasibility studies in more than than 100 cities, including the city of Iloilo in the Philippines, and has entered into strategic partnerships with 20 cities in China, including Yinchuan, Guilin, Shantou, Guang’an and Bengbu.

- Construction of SkyRail lines is expected to begin in 20 Chinese cities in 2018

- 20 km (12.5 mi) Iloilo, Philippines SkyRail system due to go into service in 2019.

- Number of cars growing in China = 15% y-o-y

- Number of roads growing in China = 1% y-o-y

- This will definitely result in traffic congestion.

- His vision of integrating a small-to-medium capacity, the Skyrail system, with the large capacity, metro system, which offers a fantastic solution cities can use to coordinate different capacity levels.

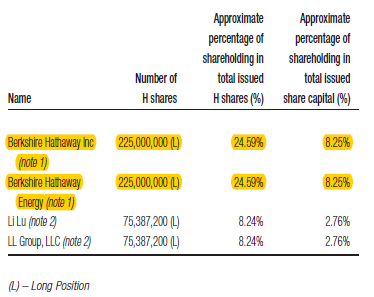

Backed by Berkshire Hathaway

In September 2008, MidAmerican Energy Holdings Company (now renamed as Berkshire Hathaway Energy), a subsidiary of Berkshire Hathaway, entered into an agreement with the Company, pursuant to which MidAmerican Energy Holdings Company acquired 225 million H Shares of the Company, representing approximately 8.25% of the Company’s total capital at present, to become the Group’s long term investment strategic partner.

- Charlie: “He is another Henry Ford.”

- Warren did not move.

- Charlie: “He is another Thomas Edison.”

- Warren still did not move.

- Charlie: “He is another Bill Gates.”

- Warren: “Okay, put me in.”

“This guy,” Munger tells Fortune, “is a combination of Thomas Edison and Jack Welch – something like Edison in solving technical problems, and something like Welch in getting done what he needs to do. I have never seen anything like it.” But Buffett and Munger and Sokol think it is a very big deal indeed. They think BYD has a shot at becoming the world’s largest automaker, primarily by selling electric cars, as well as a leader in the fast-growing solar power industry.

One more thing reassured him. Berkshire Hathaway first tried to buy 25% of BYD, but Wang turned down the offer. He wanted to be in business with Buffett – to enhance his brand and open doors in the U.S., he says – but he would not let go of more than 10% of BYD’s stock. “This was a man who didn’t want to sell his company,” Buffett says. “That was a good sign.”

Read more here. https://www.gurufocus.com/news/100041/the-byd-story

Competitors,

Tesla

- An evident competitor will be Tesla.

- However. BYD doesn’t really see Tesla as a competitor. The market is huge, leaving a ton of room for growth throughout the market. More than competitors, Tesla and BYD are partners in growing the transition to electric vehicles. Additionally, Tesla currently sells to a high-end market, while BYD serves more affordable markets, so they are simply in quite different segments.

Business Risks,

- Uncertainties in the Electric Vehicles industry, nobody knows if there will be another way to generate rechargeable batteries, or who will be the largest automaker selling electric vehicles.

MANAGEMENT

Character & Operations,

- Graduated from Central South University with a bachelor’s degree majoring in Metallurgy Physical Chemistry.

- Then graduated from Beijing Non-Ferrous Research Institute with a master’s degree majoring in Material Science.

- Spent several years as a government researcher, but in 1995 he entered the private sector and founded his own company.

- Very little appearance on media, prefer to focus more on the growth of his business rather than promoting it.

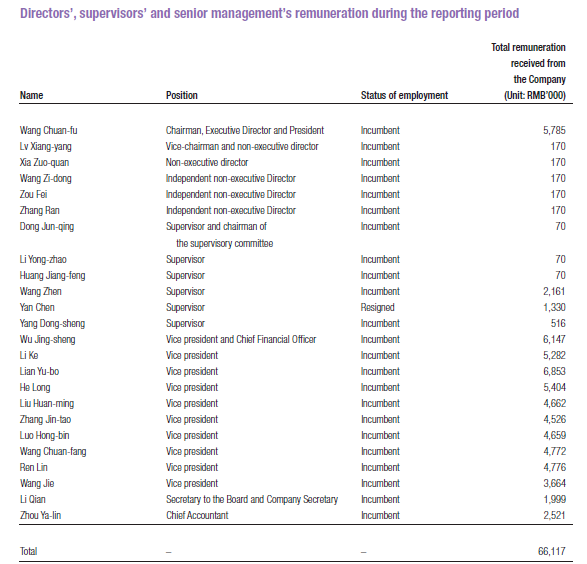

Compensation,

- Total remuneration = $66,117,000 RMB

- NPAT = $4,066,000,000

- 1.63% of NPAT (Acceptable)

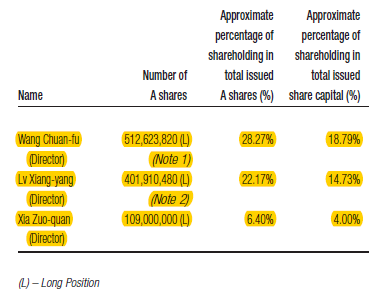

Owner-operator,

- Wang Chuan-fu (Chairman, Executive Director and President) holds 18.79% of BYD

- Lv Xiang-yang (Vice-Chairman, Wang’s cousin) holds 14.73% of BYD

- Owner-operator mentality will be there.

NUMBERS & VALUATION

Financial Stability:

- Gross Profit Margin: 19%

- Net Profit Margin: 6.7%

- Return on Equity: 7.65% (Low)

- Net Debt-Equity Ratio: 0.9 (High)

In terms of valuation, its earnings is not very predictable as it is still in the early growth stage from its Electric Vehicles and Skyrail businesses.

I am not very confident in my own valuation of this company. But the facts are pretty obvious that BYD is in a great position in leading the electric vehicles industry.

Its price has dropped from $75~ to $50~ after it reported a decrease in net profit in the latest quarter. We should not look at short term volatility and look ahead to its value it will bring in the future.

While the current share price presents an excellent opportunity for us to enter, i am still not moved by it as i feel that there are other growth companies that interest me more. (Ever heard of the hotpot restaurant, Haidilao? It is going to IPO soon!)

I will add BYD into my watchlist. In the event of a severe economic crisis, if BYD is still able to continue growing, it will definitely be a great investment opportunity.