[NASDAQ: FB]

Type: Fast Grower

Business Description: Targeted Advertising

Market Cap: $510 Billion USD

Thesis:

- Pricing Power in their ads bidding process

- Network effect in the business model, strong and sustainable moat

BUSINESS

About Facebook,

Facebook’s Products/Services

- Messenger

- Oculus

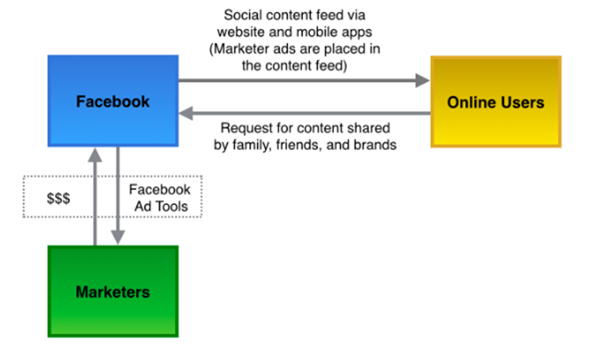

Facebook generates most of their revenues from selling advertising placements to marketers. With the massive data that they have, their ads enable marketers to reach people based on a variety of factors including age, gender, location, interests, and behaviors (Targeted marketing).

These ads appears mainly on Facebook and Instagram. So the next question will be, “How will does Facebook ads cost?”

The answer to this question can be found in this website: https://adespresso.com/blog/facebook-ads-cost/

To summarize, since advertisers are trying to get the same ads space in users’ Newsfeed and Facebook limits the number of ads each user sees, the advertisers have to bid higher price to get the ads space that they want. This is an extremely fantastic business model where Facebook has the absolute pricing power for selling its ads placements.

Facebook’s 10 Year Roadmap

This roadmap was presented during the annual F8 developers conference 2016. Facebook has been doing a great job at generating profits from ads placed on FB and Instagram. Other products such as Messenger and WhatsApp have not been monetized yet.

On the 10 years mark, Facebook aims to bring internet to the world. There are still approximately 4 billion people that still does not have any internet access, mainly from the developing countries. It seems futuristic but the world is indeed moving at an exponential pace.

What is so special about Facebook,

Approximately one-third of the world population (7 billion) are using Facebook every month. Facebook has one of the strongest moat that we called, network effects. As more people use Facebook’s products, the value of these products will increase too.

Growth Drivers,

- Development of its VR technologies, Oculus, into a profit-making product.

In the latest F8 developer conference 2018, Facebook announced that they are working together with Hasbro, a toy and board game company, to launch VR board gaming where people are able to play board games together in a virtually-enhanced experience setting.

- Workplace by Facebook

While this is still in the development phase, if it is able to connect businesses successfully, they will definitely reap profits from this B2B platform.

- Growth by Acquisitions

Up till date, Facebook has been making relevant acquisitions that compliments its business model of connecting the world.

Business Risks,

- Regulatory risk

With the recent saga on data privacy, fake news, hate speech etc., governments around the world will probably impose regulations to protect its own people. However, this is still a grey area as governments (such as in Singapore) have little or no idea on how to resolve this kind of issues.

- Loss in user confidence

After the Cambridge Analytica incident, if there is another similar kind of problem that may arise in the future, it will definitely affect users confidence on Facebook’s ability to protect its users and their information. In this case, there will be a high probability that people will doubt the platform’s effectiveness and leave Facebook.

To have a better understanding of Facebook, what it was like when it was founded in 2004 in Mark Zuckerberg’s Harvard dorm room to the current global social network platform, watch this video by Bloomberg:

MANAGEMENT

Character & Operations,

Like how Bill Gates created an amazing business, Microsoft, Mark Zuckerberg shares many similarities by creating Facebook. These two visionaries created companies that have extremely strong moat and they have contributed a lot to the society.

During the early stage of Facebook, despite many offers up to $1.5 billion by Yahoo! and MTV Networks, Mark Zuckerberg rejected all the offers as he feels that Facebook is worth more than that. He is definitely not looking at how much others are offering, he is more interested in knowing how far can Facebook grow.

This 33 year old entrepreneur is also a philanthropist. In December 2010, Zuckerberg signed the “Giving Pledge”, promising to donate at least 50 percent of his wealth to charity over the course of his lifetime. Other Giving Pledge members include Bill Gates, Warren Buffett and George Lucas.

“With a generation of younger folks who have thrived on the success of their companies, there is a big opportunity for many of us to give back earlier in our lifetime and see the impact of our philanthropic efforts,” -Mark Zuckerberg

In September 2016, Zuckerberg and Chan announced that the Chan Zuckerberg Initiative (CZI), the company into which they put their Facebook shares, would invest at least $3 billion into scientific research over the next decade to help “cure, prevent and manage all diseases in our children’s lifetime.” (Don’t be too alarmed if you see him selling his shares)

Compensation,

- Mark Zuckerberg takes home a $1 salary each year.

“I’ve made enough money. At this point, I’m just focused on making sure I do the most possible good with what I have. The main way I can help is through Facebook — giving people the power to share and connecting the world. I’m also focusing on my education and health philanthropy work outside of Facebook as well. Too many people die unnecessarily and don’t get the opportunities they deserve. There are lots of things in the world that need to get fixed and I’m just lucky to have the chance to work on fixing some of them.” -Mark Zuckerberg

Board remuneration

According to 2016 data, with board remuneration of $79.8 million and NPAT of $10.2 billion, it is 0.78% of profit after tax (although the % is low, this is because of the high profits of Facebook. The management gets around $20 million annually which is quite high.)

Owner-operator,

- Mark Zuckerberg holds around 8.78 million in Class A Facebook stock in a series of funds held with his wife, Priscilla Chan, as of his March 31, 2018, SEC filing. Zuckerberg also owns a whopping 441.6 million Class B shares. Control over nearly 89% of the Class B shares, giving Zuckerberg 60% voting rights in the company.

VALUATION

Type of Valuation:

- Discounted Earnings Model

- 25% for next five years, 20% for the following five years

- Net Cash per share: $10

- Intrinsic Value: $183

- Current price: $167.50 (20 Mar 18)

Conclusion: Fair-valued

This is a simple valuation by myself. I am not very good at using more sophisticated method like DCF to value my companies.

Fortunately, Professor Aswath Damodaran did a very detailed analysis on Facebook’s worth.

http://aswathdamodaran.blogspot.sg/2018/04/the-facebook-feeding-frenzy.html

His valuation that he obtained for Facebook with his story is about $181.

One thought on “Facebook”